This is because while some types of income are easy and cheap to generate, others require considerable effort, time, and expense. Critics of principles-based accounting systems say they can give companies far too much freedom and do not prescribe transparency. They believe because companies do not have to follow specific rules that have been set out, their reporting may provide an inaccurate picture of their financial health. Accounting information is not absolute or concrete, and standards are developed to minimize the negative effects of inconsistent data. Without these rules, comparing financial statements among companies would be extremely difficult, even within the same industry. Accounting principles are the rules and guidelines that companies and other bodies must follow when reporting financial data.

Types of Ledger Accounts

QuickBooks Online automatically sets up a chart of accounts for you based on your business, with the option to customise it as needed. Your chart of accounts is a living document for your business, meaning, over time, accounts will inevitably need to be added or removed. The general rule for adding or removing accounts is to add accounts as they come in, but wait until the end of the year or quarter to remove any old accounts. Expense accounts allow you to keep track of money that you no longer have, and represents any money that you’ve spent. For example, if you rent, the money will move from your cash account to a rent expense account. In this article you will learn about the importance of a chart of accounts and how to create one to keep track of your business’s accounts.

What Are the Different Types of Accounting?

Purchase Ledger – Purchase Ledger is a ledger in which the company organizes the transaction of purchasing the services, products, or goods from other businesses. It gives the visibility of how much amount the company paid to other businesses. For instance, the asset account records all of the changes in assets over time like asset purchases and sales. Transactions that occur frequently—such as revenues, cash receipts, purchases, and cash payments—are typically recorded as journal entries first. An account statement will also enable an individual or business to secure a debt. Most lenders use this information to gauge the financial position of the borrower.

Governmental Accounting Standards Board

Federal endorsement of GAAP began with legislation like the Securities Act of 1933 and the Securities Exchange Act of 1934, laws enforced by the U.S. Securities and Exchange Commission (SEC) that target public companies. Today, the Financial Accounting Standards Board (FASB), an independent authority, continually monitors and updates GAAP. Here is what Paul’s Guitar Shop’s year-end would look like in accounting worksheet format for the accounting cycle examples in this section. Direct and indirect expenses are monitored by a P&L report, which provides information on indirect expenses in order to help you control these costs.

Organise account names into one of the four account category types

These standards are used in approximately 168 jurisdictions, including those in the European Union (EU). Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in national real tax tracking company profile meeting their financial goals over his career. In most other countries, a set of standards governed by the International Accounting Standards Board named the International Financial Reporting Standards (IFRS) is used. By 1880, the modern profession of accounting was fully formed and recognized by the Institute of Chartered Accountants in England and Wales.

The bank statement style lends itself to modern accounting, but for the time being, double entry will be explained by the older traditional method. The record of trading transactions is kept on the folios or pages of these account books, called ledgers. The ledger folios have special rulings to suit the needs of the business. Journals are used to record transactions chronologically, but journal entries only show the effect of individual transactions.

LLC structures allow business owners to separate their personal finances from the company’s finances. Owners of LLCs cannot be held personally liable for debts incurred solely by the company. The term is sometimes used alongside “operating cost” or “operating expense” (OPEX). It is a more complete and accurate alternative to single-entry accounting, which records transactions only once. Another important fact to note stems from the fact that total assets are equal to total liabilities and capital at any given time. For example, the amount of capital that Mr. John has on the first day of the accounting period (see the previous example) will be shown on the credit side of Mr. John’s capital account.

As you can see, each account is listed numerically in financial statement order with the number in the first column and the name or description in the second column. Revenue is the amount of money your business brings in by selling its products or services to clients. Accountants calculate ROI by dividing the net profit of an investment by its cost, then multiplying by 100 to generate a percentage. For instance, imagine an investor who purchases $20,000 of a company’s stock, then sells the stock for $25,000. When an investor incurs a loss, the ROI is expressed as a negative number. In the United States, privately held companies are not required to follow GAAP, but many elect to do so voluntarily.

Nominal accounts are considered to be temporary, they are reflected on a company’s income statement as net profit or loss, and are closed at the end of every fiscal year. In other words, this measures their stake in the company and how much the shareholders or partners actually own. This section is displayed slightly different depending on the type of entity. For example a corporation would list the common stock, preferred stock, additional paid-in capital, treasury stock, and retained earnings. Meanwhile, a partnership would simply list the members’ capital account balances including the current earnings, contributions, and distributions.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

- For example, the amount payable to United Traders on the first day of the accounting period is recorded on the credit side of the United Traders Account.

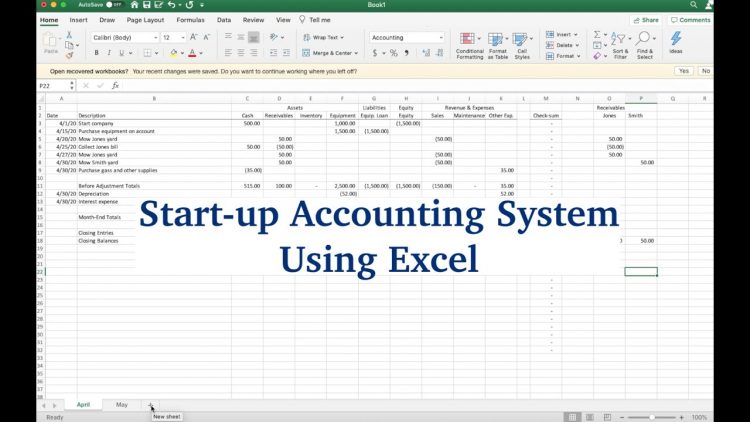

- In other words, an accounting worksheet is basically a spreadsheet that shows all of the major steps in the accounting cycle side by side.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- Accountants use “initial inventory plus purchases, minus ending inventory” as a basic accounting formula for calculating COGS over a specific accounting period.

The process of transferring information from the general journal to the general ledger, for the purpose of summarizing, is known as posting. In the past, these records would literally have been kept in bound ledger books. Meanwhile, IFRS standards are principles-based, offering more latitude and subjectivity when interpreting guidelines. The SEC receives a large number of comments and complaints about the issue. In December 2022, the SEC updated the standards it uses when evaluating financial disclosures that contain pro forma reporting. However, as of June 2024, the underlying debate remains without a definitive resolution.