Now that you know what straight-line depreciation is and why it’s important, let’s look at how to calculate it. Straight-line depreciation is often the easiest and most straightforward way of calculating depreciation, which means it can potentially result in fewer errors. These solutions are ideal for businesses with remote teams or those requiring frequent updates to their depreciation data. Mobile applications have made it possible to manage depreciation and asset tracking from anywhere. These apps often feature barcode scanning for quick asset identification, cloud synchronization for real-time updates across devices, and push notifications for important depreciation milestones or required actions.

How Depreciation is Recorded

You can use this method to anticipate the cost and value of assets like land, vehicles and machinery. While the upfront cost of these items can be shocking, calculating depreciation can actually save you money, thanks to IRS tax guidelines. Sometimes, these are combined into a single line such as “PP&E net of depreciation.”

Choosing a Depreciation Method

- The double-declining balance (DDB) method is an even more accelerated depreciation method.

- You estimate that after 5 years (its useful life), the truck will have a salvage value of $5,000.

- The sum-of-the-years’-digits method (SYD) accelerates depreciation as well but less aggressively than the declining balance method.

- Always consult with a tax professional to determine which of your business assets are eligible for depreciation.

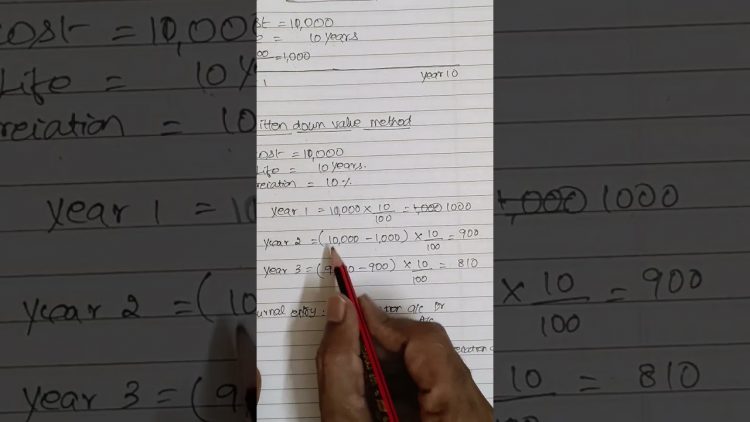

Additionally, you can calculate the depreciation rate by dividing the depreciation amount by the total depreciable cost (purchase price − estimated salvage value). By estimating depreciation, companies can spread the cost of an asset over several years. The straight-line depreciation method is a simple and reliable way small business owners can calculate depreciation. Suppose, however, that the company had been using an accelerated depreciation method, such as double-declining balance depreciation. Depreciation is an accounting method that companies use to apportion the cost of capital investments with long lives, such as real estate and machinery. The sum-of-the-years’-digits method (SYD) accelerates depreciation as well but less aggressively than the declining balance method.

Understanding Methods and Assumptions of Depreciation

As you explore these technological solutions, remember that the goal is not just to automate calculations, but to gain deeper insights into your assets’ performance depreciation expense formula and value over time. With the right technology in place, you’ll be well-equipped to manage your assets effectively and make informed financial decisions for your business’s future. Modern accounting software offers powerful features for depreciation calculation and tracking.

Depreciation is a solution for this matching problem for capitalized assets because it allocates a portion of the asset’s cost in each year of the asset’s useful life. Depreciation recapture is a provision of the tax law that requires businesses or individuals that make a profit in selling an asset—that was previously depreciated—to report it as income. In effect, the amount of money they claimed in depreciation is subtracted from the cost basis they use to determine their gain in the transaction. Recapture can be common in real estate transactions where a property that has been depreciated for tax purposes, such as an apartment building, has gained value over time. Businesses also use depreciation for tax purposes—namely, to reduce their total taxable income and, thus, reduce their tax liability. Under U.S. tax law, a business can take a deduction for the cost of an asset, thereby reducing their taxable income.

But, in most cases, the cost of the asset must be spread out over time; this is called asset depreciation. (In some instances, a business can take the entire deduction in the first year, under Section 179 of the tax code.) The IRS also has requirements for the types of assets that qualify. Depreciation is an accounting practice used to spread the cost of a tangible or physical asset, such as a piece of machinery or a fleet of cars, over its useful life. The amount an asset is depreciated in a given period of time is a representation of how much of that asset’s value has been used up.

Fishing business example

It reports an equal depreciation expense each year throughout the entire useful life of the asset until the asset is depreciated down to its salvage value. For most businesses, depreciation should be calculated and recorded at least annually when preparing year-end financial statements. Embracing technology in your depreciation calculations can lead to more accurate financial reporting, improved efficiency, and better decision-making. By choosing the right tools and implementing them effectively, you can transform what was once a tedious task into a streamlined process that adds value to your business. Tracking business expenses, including depreciation, can be made easier with accounting software.

This deeper understanding allows for more strategic asset management, improved financial planning, and better-informed business decisions. By pro-rating depreciation for assets acquired or disposed of during the fiscal year, you ensure that your financial statements reflect the true economic reality of your business. This level of precision aids in better decision-making and helps maintain the integrity of your financial records. The SYD method derives its name from the calculation process, which involves summing up the digits of the asset’s useful life.